If you’re looking to optimize your investment returns on rental properties, downloading a Total ROI Calculator in Excel can be a game-changer. This tool aids investors in analyzing various aspects of rental investments, allowing for informed decision-making that enhances profitability.

Whether you’re new to real estate investing or have a substantial portfolio, leveraging a detailed ROI calculator helps you assess potential earnings and risks more accurately. With precise calculations involving purchase price, expenses, rental income, and appreciation rates, you get a comprehensive view of your potential returns. The calculator’s Excel format is incredibly user-friendly, adaptable, and allows for scenario testing to forecast different outcomes.

A well-structured Excel ROI calculator takes into account key financial metrics such as cash flow, cap rate, and net operating income. By inputting your own data, you can instantly see how changes in rental rates, occupancy levels, or maintenance costs affect your overall investment performance. This powerful tool provides investors with the clarity needed to strategize effectively.

Moreover, utilizing the Total ROI Calculator can save time and reduce errors in manual computations. By providing a clear roadmap of your investment’s financial health, it empowers you to make decisions confidently. Download the Excel calculator now and take a significant step towards optimizing your rental property investments.

Understanding ROI in Rental Properties

Calculate the potential ROI for your rental property to evaluate its profitability accurately. Begin by identifying all sources of income and expenses related to the property.

- Income: Include monthly rent, parking fees, and any additional revenue streams like laundry services.

- Operating Expenses: Account for property taxes, insurance, maintenance, utilities, and property management fees.

- Initial Investment: Calculate your total upfront costs, such as down payment, closing costs, and any renovation expenses.

Once you have these figures, use the formula:

- Annual Cash Flow: Total Annual Income – Total Annual Operating Expenses.

- ROI Calculation: (Annual Cash Flow / Initial Investment) x 100.

A high ROI indicates a profitable investment, but consider the risk and market stability. Diversify your portfolio to minimize risk, and regularly update your calculations as market conditions change. Review local real estate trends and consult experts for a comprehensive market analysis.

Key Components of ROI in Real Estate

Focus on accurate property valuation. Understanding the true market value guides your purchasing decisions and influences profit potential. Use comprehensive property appraisals and local market comparisons.

Consider location. Proximity to amenities, public transport, and school districts can significantly augment rental rates and reduce vacancy periods. Analyze neighborhood growth trends for a clearer financial outlook.

Evaluate operating expenses rigorously. Include property management fees, maintenance, taxes, and insurance in your calculations. Ensuring precise estimation of these costs helps you gauge the net return more effectively.

Leverage financing strategies wisely. Optimal use of financing through mortgages can amplify returns by increasing properties’ purchasing power and lowering immediate capital expenditure.

Enhance rental income strategically. Regular upgrades and responsive maintenance satisfy tenants and justify premium pricing. Tailoring small improvements like modern fixtures or energy-efficient appliances can elevate rent.

Assess tax implications carefully. Familiarize yourself with property tax laws and deductions available for landlords. Strategic tax planning can improve the net yield of your investment.

Monitor cash flow closely. Positive cash flow ensures the investment is self-sustaining and reduces financial risk. Keep track of incoming rent versus total expenditures for ongoing fiscal health.

Differentiating Between Gross and Net ROI

Always calculate Gross ROI by dividing total rental income by the initial investment cost. This quick calculation provides an overview of potential profitability without considering operational costs. For a more accurate financial picture, shift your focus to Net ROI, which incorporates expenses such as maintenance, property management fees, taxes, and insurance. To compute Net ROI, subtract these expenses from your rental income, then divide by the investment cost.

Understanding these distinctions aids in better investment decisions. For instance, a property with a high Gross ROI may have a significantly lower Net ROI due to high operating costs. Use both metrics in tandem to gauge a property’s attractiveness and potential pitfalls. A keen awareness of these calculations ensures you pinpoint the most lucrative opportunities while steering clear of financially draining investments.

Adopting spreadsheets to track all variables accurately is beneficial. Excel programs specifically tailored for rental properties can automate these calculations, allowing you to adjust variables and immediately see their impact on both Gross and Net ROI. By mastering both metrics, you position yourself to optimize investment returns effectively.

Common Mistakes in Calculating ROI

Avoid inaccurate estimations of rental income by factoring in realistic figures. Over-optimism in rental demand or rental rates skews your ROI calculation significantly. Ensure you account for market trends and historical vacancy rates to provide a balanced view.

- Ignoring Operational Expenses: Always include property management fees, maintenance costs, insurance, and property taxes in your calculations. Failing to account for these costs often leads to an overestimated ROI.

- Neglecting Financing Costs: If leveraging a mortgage, ensure interest payments are part of your cost evaluation. The overlooked interest can drastically alter profit projections.

- Underestimating Vacancy Periods: Consider potential vacancy windows and reserve funds to cover periods without rent. It ensures your cash flow estimation remains practical and prevents budget strains.

- Overlooking Long-Term Appreciation: While ROI is short-term focused, consider future property value increases. Though not direct, appreciation potential influences overall investment attractiveness.

- Using Gross Income Instead of Net Income: Calculating ROI based on gross rent provides a distorted view. Net income, which deducts all operational expenses from your rental income, offers a more accurate ROI.

By paying attention to these aspects and integrating them into your ROI calculations, you gain a more accurate understanding of the true profitability of your rental property investment.

The Impact of Property Management on ROI

Investing in a skilled property management company can significantly increase your rental property’s ROI. A competent manager optimizes tenant selection, ensuring longer leases and reduced turnover, which directly influences income streams and decreases vacancy rates. Consider that experienced property managers employ rigorous screening processes. This reduces the likelihood of late payments and defaults, preserving your cash flow and enhancing profitability.

Effective maintenance is another critical factor. Routine inspections and prompt repairs prevent minor problems from escalating into costly issues, protecting your investment and keeping tenants satisfied. A well-maintained property not only retains its value but can also justify rental increases, further boosting your ROI.

Compliance with local laws and regulations is paramount. Property managers versed in legalities prevent fines and legal disputes, ensuring you’re not caught off guard. They handle everything from lease agreements to property taxes, safeguarding your investment while letting you focus on other pursuits.

Proactive marketing strategies employed by managers guarantee high occupancy rates. Targeted advertising, along with strategic pricing, minimizes vacancies and maximizes rental income. Marketing expertise attracts quality tenants and accelerates lease renewals.

| Key Aspect | Benefit to ROI |

|---|---|

| Tenant Screening | Reduces turnover and defaults, stabilizing cash flow. |

| Maintenance | Preserves property value and justifies rental increases. |

| Legal Compliance | Avoids penalties and legal fees, ensuring seamless operations. |

| Marketing | Ensures high occupancy rates and quick lease renewals. |

By leveraging professional property management, property owners can optimize revenue and preserve asset value, making it a pivotal factor in enhancing overall ROI.

Using the Excel ROI Calculator for Accurate Forecasts

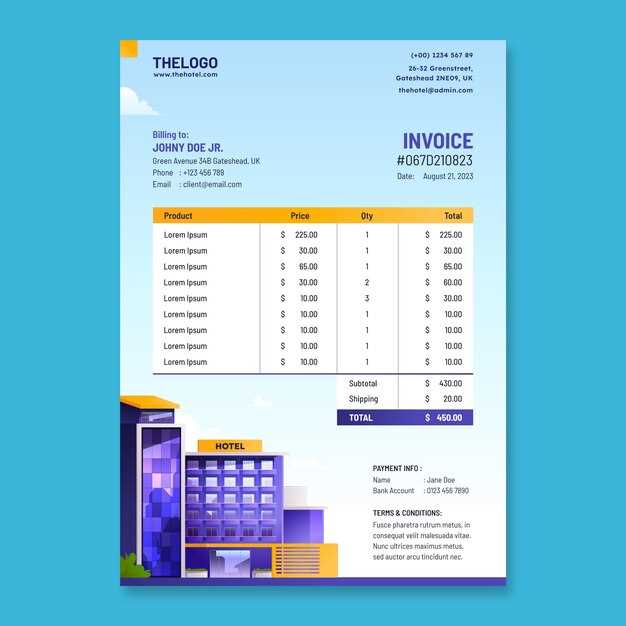

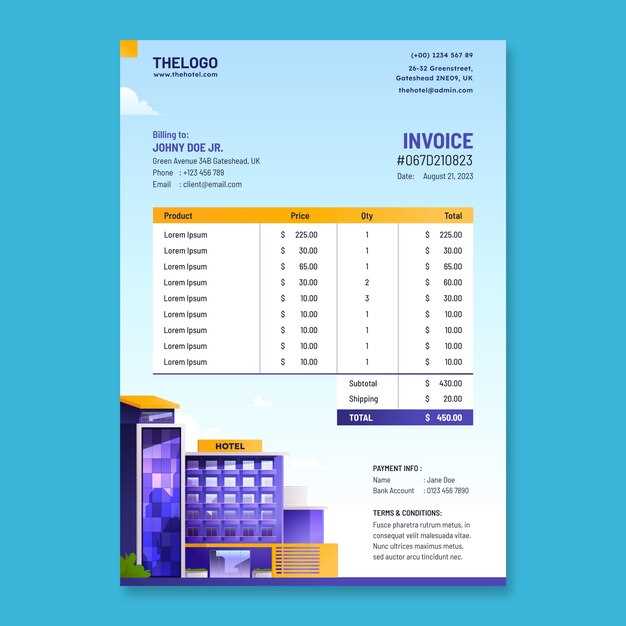

Choose well-researched data to input into your Excel ROI Calculator. Accurately forecasting rental property returns hinges on the reliability of your data. Start with the purchase price, including all closing costs, and ensure these are listed in the calculator. Factor in expected monthly rental income, reflecting current market conditions.

Analyze the property’s monthly expenses, such as property management fees, maintenance, property taxes, and insurance. Enter these as consistent recurring costs, as overlooking them can skew anticipated results. Don’t forget to estimate vacancy rates based on historical data or market trends. This helps in generating more realistic projections over the investment period.

Adjust the appreciation rate to reflect actual market trends rather than optimistic assumptions. This ensures that your forecasted return mirrors potential real-world outcomes. Similarly, input expected annual property tax and insurance rate increases, using a realistic percentage that aligns with local historical data.

Consider utilizing the calculator’s features to perform sensitivity analyses. Adjust variables like rental income or property value growth rates to understand their effects on ROI. This approach provides a risk assessment and prepares you for different market conditions.

Regularly update the calculator with new data as it becomes available. This involves reassessing market rents, tax laws, and local regulations that might affect property expenses. Continual updates ensure that your forecasts remain accurate and relevant.

How to Input Data into the ROI Calculator

First, gather all necessary property details, such as purchase price, renovation costs, and any projected ongoing expenses. Ensure accuracy to maintain validity in calculations.

Input Purchase Price: Locate the designated cell for the property’s purchase price and type in the amount. This should reflect the total acquisition cost, including closing fees.

Enter Renovation Costs: Sum up all renovation expenses you anticipate or have incurred. Enter this figure into the specified cell dedicated to upgrade expenses. This helps project total investment.

Add Monthly Income: Estimate or input the expected monthly rental income. This figure is crucial for assessing potential returns and should be as accurate as possible from market research.

List Ongoing Expenses: Include property management fees, maintenance, insurance, and property tax. Input these amounts in the respective fields to gauge net profit.

Calculate Loan Details: If financing with a mortgage, fill in loan amount, interest rate, and term. This influences monthly cash flow and ROI projections. Ensure these details are up-to-date.

Check all entries before running calculations. Accuracy ensures the reliability of your ROI analysis.

Customizing the Calculator for Different Property Types

Identify the specific characteristics of each property type you want to analyze. For instance, single-family homes might necessitate a focus on mortgage rates and potential vacancy periods, whereas multi-family units demand an assessment of shared maintenance costs and tenant turnover rates. Adapt each input field in your spreadsheet to reflect these factors accurately.

To account for unique expenses tied to various property types, consider adding separate columns for costs such as homeowner association fees for condos or specialized insurance for vacation rentals. These additions ensure that your calculations capture all relevant financial responsibilities, enhancing accuracy in ROI projections.

If dealing with commercial properties, factor in aspects like zoning laws, potential property taxes, and the duration of lease agreements. Adjust the calculator to integrate these parameters by creating sections dedicated to these unique costs and revenue projections.

Leverage Excel’s conditional formatting to highlight key metrics or thresholds that could trigger alerts. For instance, set up alerts for occupancy rates dropping below a set level in an apartment complex or for increased utility expenses affecting the cash flow of industrial properties.

Make your calculator versatile by incorporating scenarios that reflect changes in market conditions or property management strategies. Use different sheets or tabs to simulate these “what-if” situations, allowing you to visualize the impact on your ROI under varying assumptions, such as fluctuating rental income or interest rates.

Analyzing the Output: What to Look For

Focus on the Net Operating Income (NOI) first. This key metric indicates the profitability of your property without considering mortgage payments. A higher NOI suggests better performance. Investigate any unexpected changes or trends.

Next, examine the Cap Rate, calculated as NOI divided by the property’s value. It helps compare profitability relative to similar investments. Aim for a cap rate that aligns with your investment goals.

Pay attention to the Cash-on-Cash Return. It measures cash income against cash invested, reflecting the efficiency of your investment. A healthy return indicates sound financial leverage.

Check the Gross Rent Multiplier (GRM), calculated by dividing the property’s price by its gross rental income. Lower GRM values usually point to better investment opportunities, indicating a faster return period.

Evaluate the Internal Rate of Return (IRR) to assess long-term profitability. It represents annualized growth, including time value of money. Compare IRR against other investments to decide on optimal fund allocation.

Scrutinize maintenance and vacancy costs as hidden erosion points in profitability. Ensure these are within reasonable percentage ranges of total income to secure better returns.

| Metric | Interpretation | Strategy |

|---|---|---|

| Net Operating Income (NOI) | Profitability without mortgage impact | Maximize by controlling expenses |

| Cap Rate | Profit relative to investment value | Target depending on risk profile |

| Cash-on-Cash Return | Cash efficiency against investment | Compare annually for growth |

| Gross Rent Multiplier (GRM) | Return period indication | Aim for lower values |

| Internal Rate of Return (IRR) | Annualized growth measure | Evaluate over long term |

| Maintenance and Vacancy Costs | Potential profitability drains | Keep within reasonable limits |

Analyzing these metrics collectively provides a clearer financial picture. Always consider them within the context of your investment strategy for informed decision-making.

Integrating Additional Financial Metrics

Enhance your rental property analysis by incorporating key financial metrics beyond traditional ROI. This approach can provide a more holistic view of your investment’s potential and risks. Start by including the following metrics into your calculator:

- Cash Flow: Calculate your monthly cash flow by subtracting total monthly expenses from total rental income. This ensures that you have a clear picture of the immediate financial benefit or shortfall.

- Net Operating Income (NOI): Determine your NOI by taking the annual income and deducting all operating expenses. It helps measure the profitability of your property before accounting for taxes and financing costs.

- Cap Rate: Divide your NOI by the property’s purchase price. This metric allows you to compare the profitability of different investment opportunities irrespective of their financing structure.

- Gross Rent Multiplier (GRM): Provide a quick snapshot of investment value by dividing the property’s purchase price by its annual gross rental income. Lower GRMs often indicate better investment opportunities.

- Debt Service Coverage Ratio (DSCR): Obtain this by dividing your NOI by total debt service. A DSCR greater than 1 indicates that the property generates enough income to cover its debt obligations.

- Internal Rate of Return (IRR): Calculate IRR to determine the annualized rate of return of the investment throughout its lifecycle. This complex calculation requires consideration of projected cash flows and sale proceeds.

Integrating these metrics into your Excel tool will not only enhance your understanding but also empower you to make more strategic decisions for your rental property investments.

Q&A:

How can the Total ROI Calculator for Rental Properties assist me in property investment decisions?

The Total ROI Calculator for Rental Properties is designed to help you evaluate the profitability of investment properties. By inputting details such as purchase price, rental income, expenses, and financing details, the calculator provides a clear picture of potential returns. This aids investors in comparing different properties and making informed decisions based on projected returns, risk levels, and expense management.

What kind of data do I need to input into the Excel calculator to get accurate results?

To get accurate results from the calculator, you’ll need to input various data points, including the purchase price of the property, expected rental income, property management fees, maintenance costs, taxes, insurance, and any financing details such as loan interest rates and repayment terms. Accurate data ensures the calculator provides realistic projections of potential returns and risks associated with the property investment.

Can the calculator handle multiple properties at once, or is it designed for analyzing single properties only?

The calculator, as an Excel tool, typically analyzes one property at a time. However, you can create additional copies of the spreadsheet to evaluate multiple properties individually. While it doesn’t consolidate multiple properties within the same sheet, it allows for side-by-side comparison by opening multiple instances of the tool. This enables investors to analyze different properties and compare potential returns for more strategic decision-making.

Is the Total ROI Calculator suitable for beginners in real estate investment?

Yes, the Total ROI Calculator is user-friendly and suitable for beginners in real estate investment. It provides a straightforward interface for entering data and offers clear outputs that illustrate the potential return on investment. Additionally, the spreadsheet format allows new investors to tweak numbers easily and see how different variables affect ROI, providing a great learning tool for those new to property investment.

What limitations should I be aware of when using the Total ROI Calculator for assessing rental properties?

While the Total ROI Calculator is a valuable tool, it has some limitations. It relies heavily on the accuracy of the input data; inaccurate data can skew results. The tool provides estimates based on static inputs and doesn’t account for market fluctuations, unexpected expenses, or changes in interest rates over time. It also doesn’t consider qualitative factors like neighborhood quality or future development plans. Therefore, it’s best used as one component of a comprehensive investment analysis.

How can the Total ROI Calculator for Rental Properties in Excel help me evaluate my investment options?

The Total ROI Calculator for Rental Properties in Excel is designed to assist investors in assessing the potential return on investment for rental properties. By inputting details such as purchase price, monthly rent, expenses, and financing options, users can receive an estimated ROI. This helps in comparing different properties, understanding potential profit margins, and making informed investment decisions. The calculator also factors in various costs and revenues to project long-term financial outcomes, giving a clearer picture of the property’s financial viability.

What are the key features of the Total ROI Calculator and how user-friendly is it?

The Total ROI Calculator for Rental Properties includes several key features. It allows users to input basic property data, calculate loan costs, and estimate potential tax implications. The spreadsheet is often structured with a user-friendly interface, featuring labeled sections and instructions to guide users through the input process. Calculations are automated, providing instant ROI results based on user input. The calculator’s design often aims at simplicity, making it accessible even for those with limited Excel experience, whilst still providing comprehensive insights into property investments.